|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Cat Insurance: A Comprehensive GuideIn today's world, where pets are cherished as family members, the concept of cat insurance has emerged as a critical safety net for feline lovers. While many people are familiar with health insurance for themselves, pet insurance, particularly for cats, is still a burgeoning field that holds immense potential for safeguarding our furry companions. This article delves into the nuances of cat insurance, offering insights into its key features and highlighting why it might be a prudent choice for cat owners. What is Cat Insurance? At its core, cat insurance is designed to help cover unexpected veterinary costs. These policies can range from basic coverage, which might include accidents and illnesses, to more comprehensive plans that cover routine care, such as vaccinations and check-ups. With the rising costs of veterinary services, having a policy in place can alleviate financial strain and ensure that your feline friend receives the best possible care. Key Features and Highlights When exploring cat insurance options, several features stand out that prospective policyholders should consider. First, coverage options can vary significantly; some policies might only cover accidents, while others offer extensive illness coverage, including chronic conditions. Additionally, policies may differ in terms of deductibles and premiums, which can impact the overall affordability and suitability for different budgets. It's crucial to assess the waiting periods for coverage to begin and understand any exclusions that may apply, such as pre-existing conditions or specific breed-related health issues. Another critical consideration is the policy's reimbursement model. Some insurers offer a percentage-based reimbursement, while others might have a fixed fee schedule. Choosing the right model depends largely on personal preferences and financial strategies. Furthermore, the flexibility of choosing one's veterinarian is often a significant factor for pet owners who prefer specific clinics or specialists. Why Cat Insurance is Worth Considering The decision to invest in cat insurance is often accompanied by an internal debate: is it truly necessary? For many, the peace of mind knowing that unexpected veterinary bills won't lead to financial distress is invaluable. Moreover, insurance can facilitate prompt medical attention for your cat, ensuring that health issues are addressed swiftly and effectively. In an era where veterinary medicine is advancing rapidly, having access to cutting-edge treatments without the burden of exorbitant costs can be a game-changer for pet health. Despite some opinions that insurance premiums might accumulate to a significant amount over time, it's essential to weigh this against the potential costs of emergency surgeries or treatments for chronic illnesses. Ultimately, the choice to insure a cat should be informed by a balance between risk tolerance, financial stability, and the desire to provide optimal care for a beloved pet.

FAQWhat does cat insurance typically cover? Cat insurance usually covers accidents, illnesses, and sometimes routine care, but specifics vary by policy. Are pre-existing conditions covered by cat insurance? Most policies do not cover pre-existing conditions, so it's vital to enroll your cat while they're healthy. How are premiums determined? Premiums are usually based on factors like the cat's age, breed, health status, and the chosen coverage level. Is there a waiting period before coverage begins? Yes, most insurers have a waiting period before coverage starts, often ranging from a few days to a month. Can I use any veterinarian with cat insurance? Many policies allow you to choose any licensed veterinarian, but it's best to confirm with the insurer. https://www.aspcapetinsurance.com/cat-insurance/

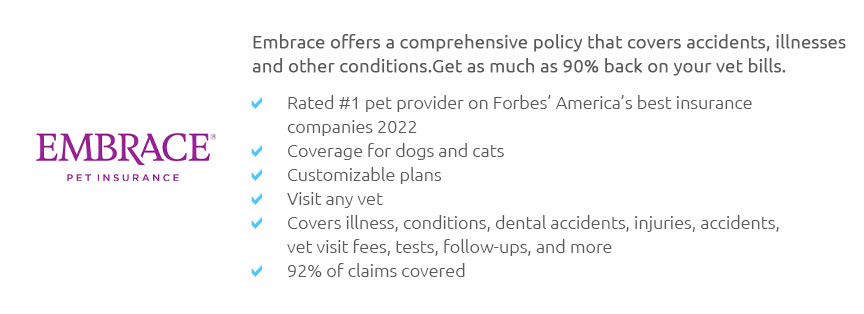

cat insurance - Coverage for accidents, illnesses, and more - Visit any licensed veterinarian or specialist in the US or Canada - Optional preventive care ... https://www.embracepetinsurance.com/cat-insurance

Our cat insurance is customizable and covers accidents, illnesses, and more conditions, plus diagnostic exam fees, treatments, and ongoing care. https://www.trupanion.com/

Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote!

|